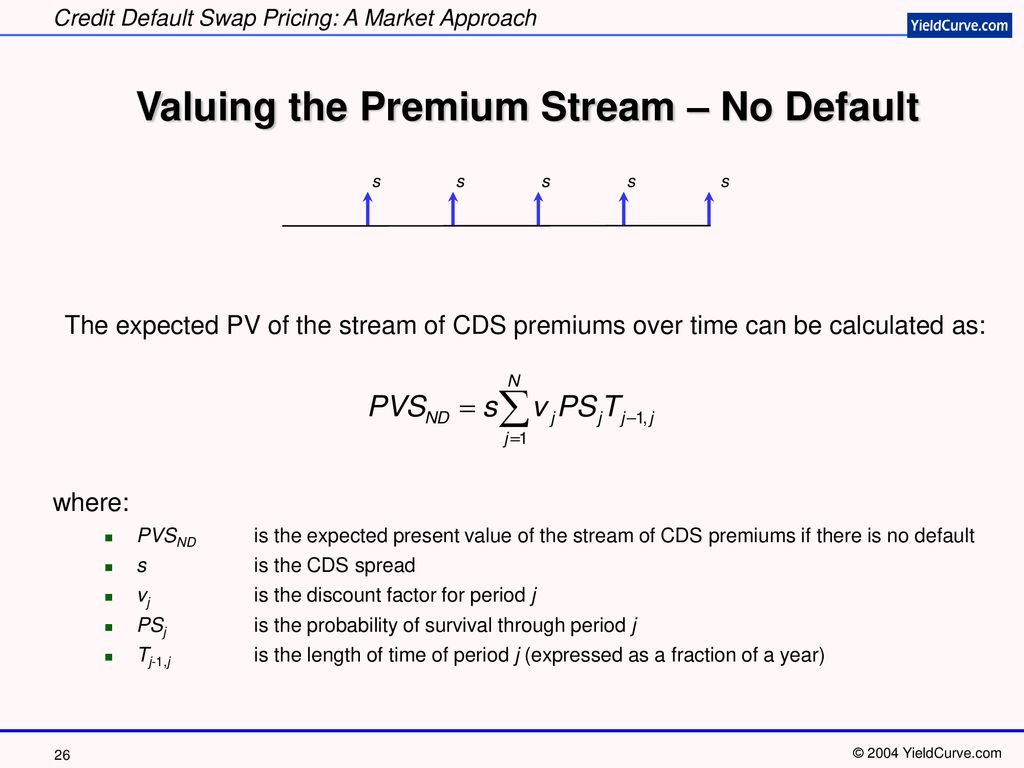

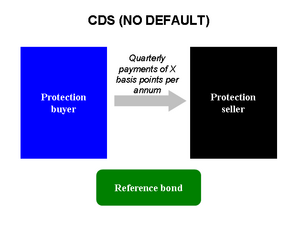

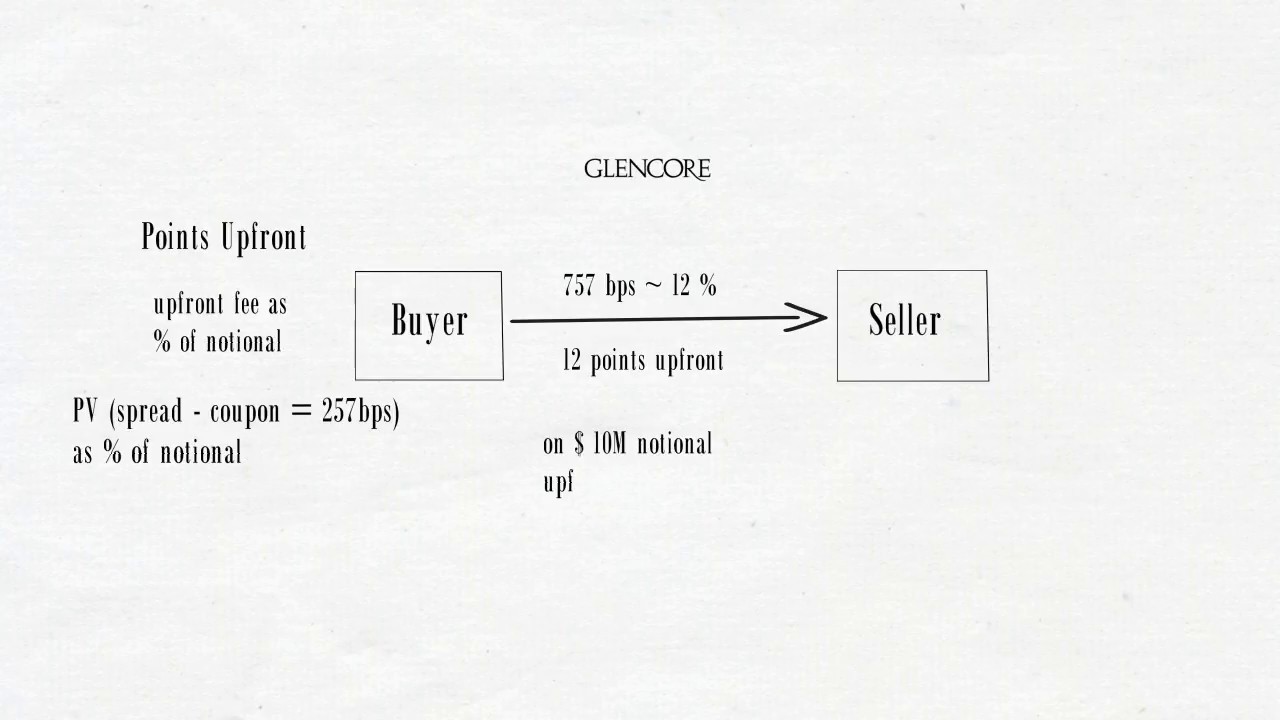

Ming Zhao on X: "4/ How are CDS swaps priced? TLDR: Price (aka "premium") of a CDS is determined by setting buyer expected value (EV) equal to seller EV and solving the

Ming Zhao on X: "4/ How are CDS swaps priced? TLDR: Price (aka "premium") of a CDS is determined by setting buyer expected value (EV) equal to seller EV and solving the

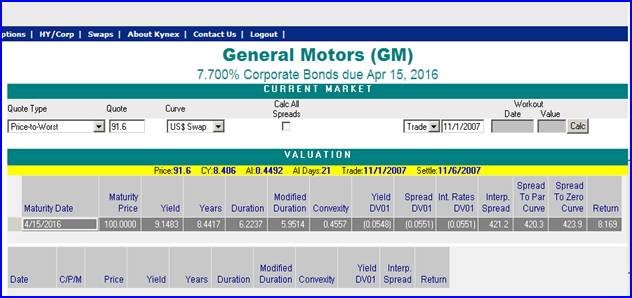

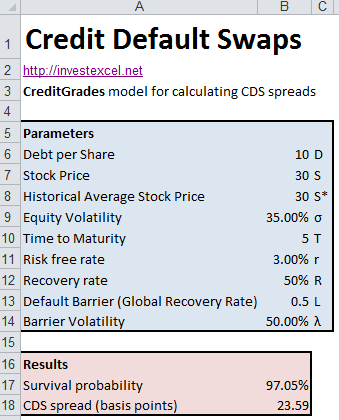

Credit Default Swap (CDS). We are often worried when we lend money… | by Farhad Malik | FinTechExplained | Medium

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-06-acd73a07b27f4ea38d124481e271fe49.jpg)